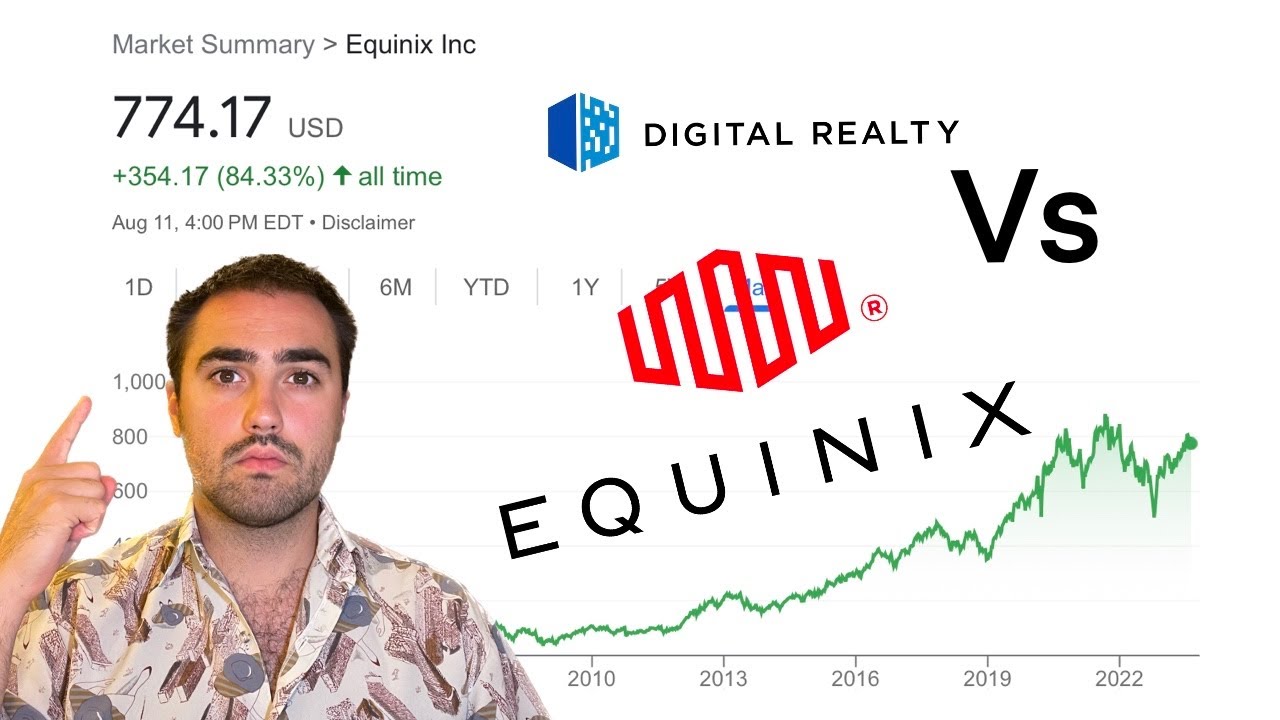

In this video, we embark on a comprehensive exploration of Equinix and Digital Realty Trust. Our focus will be on essential financial metrics such as revenue growth, profit margins, and funds from operations (FFO), offering you a clear understanding of their financial stability and ability to generate returns.

Valuation plays a pivotal role in investment decisions, and we’re here to break it down for you. We’ll analyze the price-to-earnings (P/E) ratios of Equinix and Digital Realty Trust, helping you evaluate whether their stocks are attractively priced based on their earnings potential.

Dividends are a key aspect of many investors’ portfolios, and we’ve got that covered too. Join us as we dive into the dividend yield and dividend growth of both companies, highlighting the consistent income streams they can provide to long-term investors.

Furthermore, we’ll delve into the competitive landscapes of Equinix and Digital Realty Trust. This includes exploring their strategic positioning in the dynamic world of data centers and communication infrastructure.

Whether you’re seeking stability, growth, or a combination of both, this video aims to provide you with the knowledge you need to make well-informed investment decisions.

Don’t forget to subscribe to our channel for more insightful finance content. Stay informed about the latest investment trends, strategies, and market developments.

Witness the investment showdown between Equinix and Digital Realty Trust. Tune in now and elevate your investment game!”

This video description is crafted for viewers interested in investing and emphasizes key financial metrics such as revenue growth, profit margins, FFO, P/E ratio, dividend yield, and dividend growth. It highlights the potential of Equinix and Digital Realty Trust as investment options in the REIT sector and encourages viewers to subscribe for more finance-related content.

THIS IS NO FINANCIAL ADVISE YOU ARE RESPONSIBLE FOR 100% OF ALL YOU TRADE. I TAKE NO RESPONSIBILITY IF U BUY OR SELL SHARES DUE TO ME TALKING ABOUT THEM. SELLING OPTIONS IS VERY RISKY YOU MIGHT LOSE ALL YOUR MONEY.

YOU HAVE TO ASSUME THAT EVERYTHING I SAY IS WRONG AND WILL LEAD TO AT TOTAL LOST OF MY MONEY.

I hope you enjoy:)

PLS like, comment and subscribe:)

#KNTV #kncashtv #nasdaq #optionselling #options #money #cashsecuredputs #AmericanTower #Dividends #SP500 #calloption #putoption #finance #stocks #wallstreet #getrichdietrying