Like most Americans, Chris Pappas, associate director with Marcus & Millichap’s Net Lease Division, is keenly attuned to what is happening in the Presidential race.

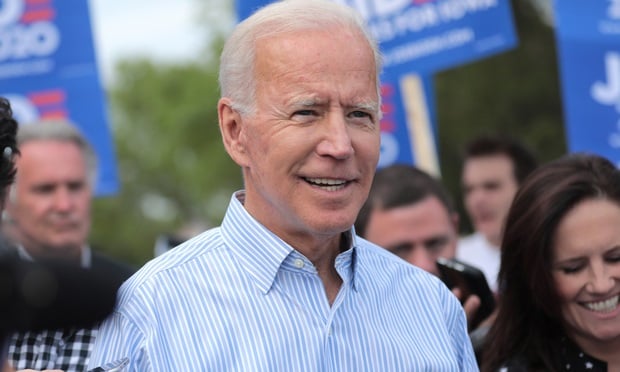

If former Vice President Joe Biden wins, Pappas is prepared for the demise of the 1031 exchange program. In July, Biden proposed ending 1031 “like-kind” exchanges for investors with annual incomes above $400,000 to fund child care and care for the elderly, which is projected to cost $775 billion over 10 years.

“For the net lease sector, one of the big questions is whether or not a Biden administration would try to terminate the 1031 exchange,” Pappas says. “That is on the table.”

If it happens, Pappas expects a big influx of inventory from owners that have been considering a transition into NNN management free assets, which are the ones that he sells.

“Owners of management intensive assets will likely look at news of a 1031 repeal as their last chance to sell their assets and transition into triple net properties without having a major tax implication and completely defer taxes,” Pappas says.

Long term, Pappas thinks a move to end 1031 exchanges could change the way investors look at sales.

“Owners would be less likely to sell because they don’t have the ability to defer taxes,” Pappas says. “This will absolutely be a material consideration in the sale decision. Repealing the 1031 will likely result in a major transaction volume decline as many investors opt to hold until they receive a tax basis step-up upon death. However, repeal of basis step-up is also being discussed which would also have a seismic impact. For those in the NNN sector, these proposals are definitely something we’re concerned about.”

Over the summer, 1031 investors helped drive velocity in an otherwise floundering net lease sales market after they were given an extension by The Internal Revenue Service in April. h

Right now, those 1031 exchange buyers are fading as the year comes to a close, regardless of what happens in the election. “What we’re seeing now in our business is that non-exchange buyers are coming back into the business and they are very attracted to the low interest rate environment,” Pappas says. “They have cash that’s been sitting around during the pandemic that wasn’t earning them much.”

Pappas thinks those non-exchange buyers will be active going forward. “They want to get back into the mix because interest rates are so low and they have that clarity of the impacts on each individual sector,” he says.

But Pappas says 1031 investors are still key players in the net lease market, regardless of the cycle.

“The 1031 is often demonized as a loophole for the rich, but it also saved the jobs of many everyday Americans throughout the pandemic,” he says. “Struggling businesses with real estate holdings, such as restaurant franchisees and industrial owner-operators, performed sale-leasebacks during COVID to quickly raise cash to satisfy debt obligations and make payroll. These sale-leasebacks are commonly structured as NNN assets, and without demand from 1031 exchange buyers these companies may have failed resulting in significant layoffs.”