SEATTLE—COVID-19 has accelerated e-commerce adoption, resulting in strong online sales for retailers such as Target, Walmart and Amazon. Although the newest of the three companies, Amazon’s head start in building out its pure online delivery platform sets it apart from its competition, likely translating into a long-term standing as the number one online platform, according to a report by CoStar Advisory Services.

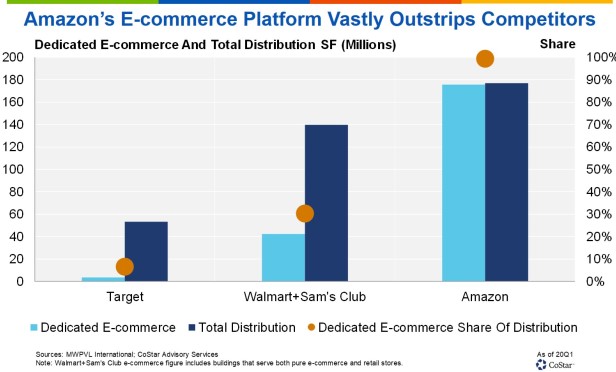

And, Amazon’s e-commerce delivery platform is by far the largest, with its dedicated e-commerce infrastructure vastly outstripping both of its major competitors. With around 180 million square feet of distribution facilities in the country, Amazon is far ahead of Walmart, which has around 140 million square feet and Target with less than 60 million square feet.

Since its founding in the 1990s, Amazon has invested heavily in expanding its delivery operation through investments in large distribution facilities and by focusing on smaller infill properties in recent years. With almost 100% of its distribution network serving purely online fulfillment orders, the company is best positioned to serve surging e-commerce demand as it directs more control over the order fulfillment process.

“Although Walmart plus Sam’s Club and Target have retail and distribution footprints 4.6 times and 1.5 times the size of Amazon’s respectively, Amazon is more efficient in its use of real estate,” says Juan Arias, senior consultant with CoStar Advisory Services. “In the US, Amazon earns around $600 dollars in merchandise sales per retail and distribution square foot, 34% higher than Walmart and 120% higher than Target. Despite planning to add over 10 times more real estate space to its platform in the next couple of years, Amazon is expected to continue to outpace its competitors in terms of merchandise sales per square foot, partly aided by accelerated sales growth due to COVID-19.”

The surge in sales growth brought on by COVID-19 will allow Amazon to continue to invest heavily in building out its delivery operations without continued damage to profitability. The US industrial market was already poised for the highest completions in 2020 since the turn of the century.

Despite construction delays due to the outbreak, supply growth is still expected to be strong in 2020 with around 200 million square feet of new logistics space added, about the same as the average level of 190 million square feet achieved since 2016. Around 30% of this new supply will be absorbed by Amazon in 2020-21 as the company continues to expand its last-mile delivery platform, a strategy that favors both new and existing infill industrial assets in strong demographic locations.

“Tight market conditions suggest Amazon will continue to pay a premium for the space it leases,” says Arias. “As the e-commerce giant continues to absorb well located and pricier last-mile assets, which it has done since 2015, it will continue to pay a higher rent premium.”

In fact, the gap between overall national logistics rents and the average rent Amazon pays will continue to widen in 2020 from the 50% premium paid by Amazon today. By the end of 2020, Amazon is expected to absorb more than 100 delivery stations with construction delays pushing some deliveries into 2021. These smaller last-mile properties which average around 200,000 square feet will represent about half of Amazon’s absorbed square footage in the next few years, while the remainder will go to larger distribution properties averaging around 700,000 square feet.

“Around one-third of these locations will be in the states of California, Texas and Florida, with Amazon targeting markets which have seen strong population growth as well as consumer buying power growth over the last cycle,” Arias tells GlobeSt.com. “Markets such as DFW, Inland Empire, East Bay/Oakland, Tampa/St. Petersburg, South Florida, Orange County, Sacramento, Orlando, Houston, San Diego and Jacksonville are just a few of the markets that will see expansions by Amazon in these states. Outside of these states, other major regional distribution markets like Chicago, Philadelphia and Northern New Jersey are also expected to see significant expansions by Amazon.”

Despite headwinds from a weakened consumer, a recovering economy in 2021 coupled with strong absorption from e-commerce should help maintain a healthy industrial space market. Absorption by Amazon and increased demand from other e-commerce retailers such as Walmart, which is already planning to invest in automated grocery warehouses, will keep industrial vacancies from rising sharply.

“Keep in mind that Amazon represents less than 5% of US retail trade and food services sales (excluding auto and gas) as of 2019 annual totals, so it is still in its expansion mode,” Arias tells GlobeSt.com. “Amazon has represented around 30% of demand for warehouse and distribution space in the last cycle, and we expect it will continue to represent a significant share in coming years. This demand for logistics space will continue to result in new logistics developments around the country and we are already expecting a supply wave by the end of the year/early next, and will continue to drive vacancies lower in newer cross-docked facilities and well-located infill product. This will also continue to drive rent growth for industrial space, which will continue to attract investor interest.”